Wake County Public Schools Payroll Calendar: A Comprehensive Guide

The Wake County Public Schools (WCPSS) Payroll Calendar is an indispensable tool for employees to plan their finances and stay informed about their pay schedules. This comprehensive guide will provide you with an overview of the payroll calendar, its key features, and how to use it effectively for financial planning.

The WCPSS Payroll Calendar Artikels the pay dates, holidays, and other important information for all employees. It is a valuable resource for budgeting, planning expenses, and ensuring financial stability.

Overview of Wake County Public Schools (WCPSS) Payroll Calendar

The Wake County Public Schools (WCPSS) Payroll Calendar provides employees with important information regarding their pay dates throughout the year. This calendar is essential for planning financial obligations and ensuring timely access to earnings.

Key features and benefits of using the WCPSS Payroll Calendar include:

- Accurate and up-to-date information: The calendar is regularly updated to reflect any changes in pay dates due to holidays or other events.

- Easy accessibility: The calendar is available online and can be accessed from any device with internet connection.

- Planning and budgeting: The calendar allows employees to plan their expenses and budget accordingly, avoiding financial surprises.

- Timely receipt of payments: By being aware of pay dates, employees can ensure that they receive their earnings on time and avoid potential delays.

Accessing and Understanding the Payroll Calendar

Accessing the WCPSS payroll calendar is a breeze. Simply head to the official website, navigate to the ‘Employees’ section, and click on ‘Payroll Calendar.’ Once there, you’ll be greeted with a comprehensive and easy-to-use calendar.

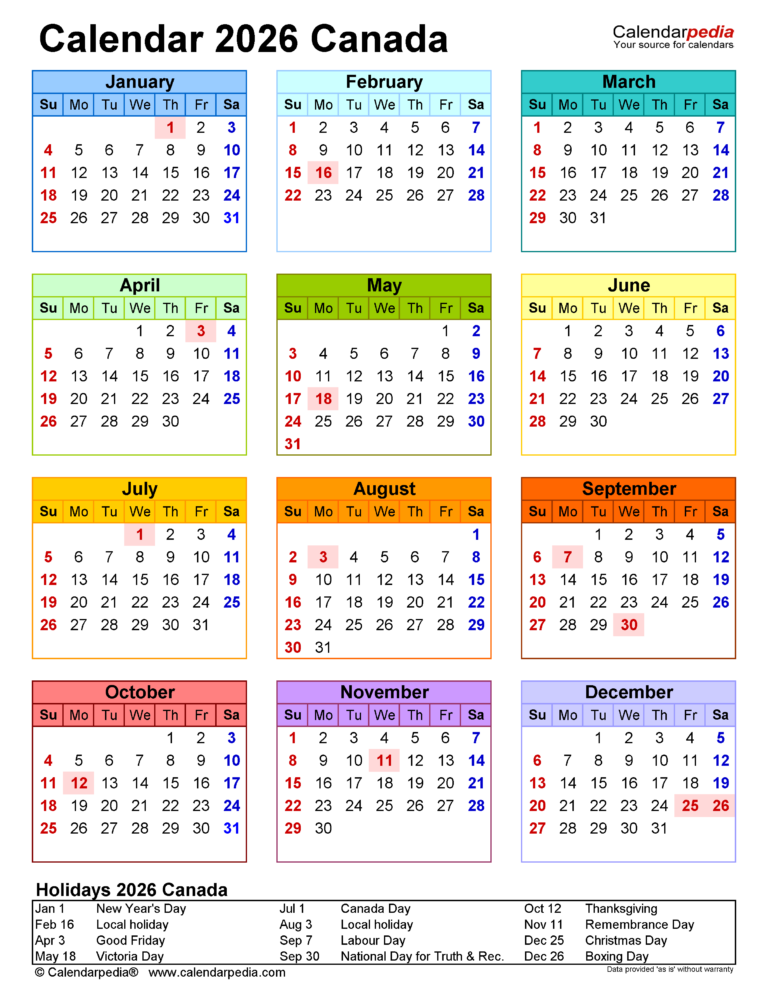

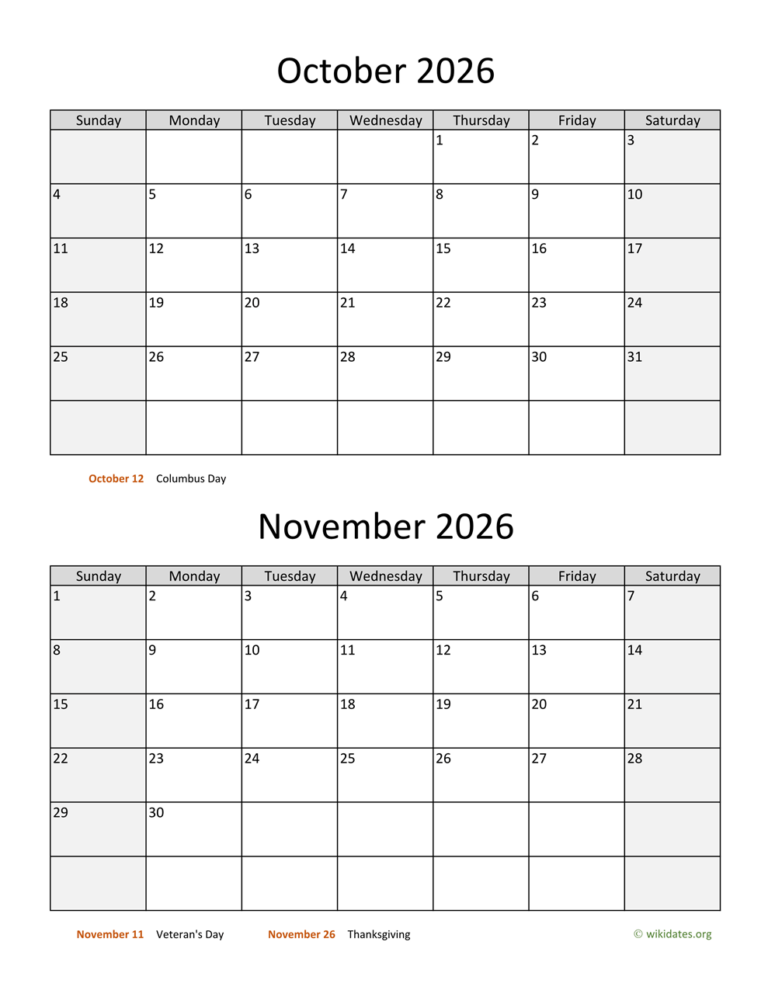

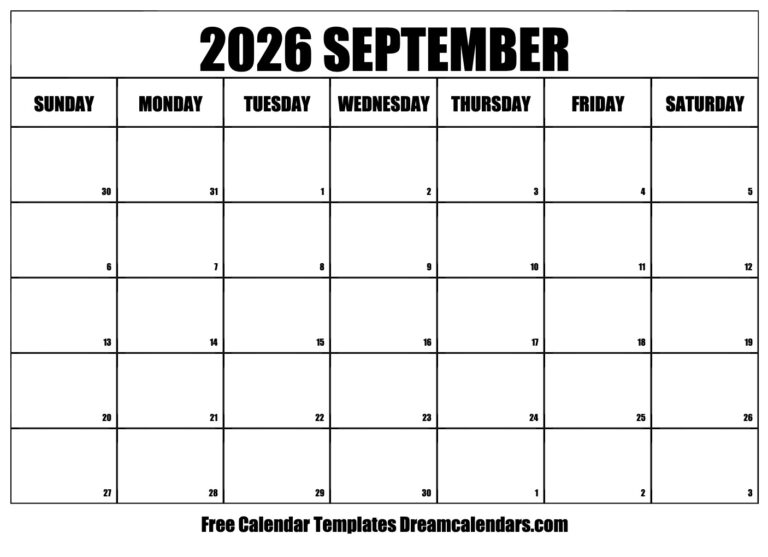

The calendar is laid out in a user-friendly manner, with pay dates, holidays, and other important information clearly displayed. Each month is presented in a separate table, making it simple to find the details you need.

Types of Information Included

The WCPSS payroll calendar provides a wealth of information, including:

- Pay dates: The dates on which you will receive your salary.

- Holidays: A list of all official holidays observed by the school district.

- Deductions: Information on any deductions that will be taken from your paycheck, such as taxes, health insurance premiums, and retirement contributions.

Using the Payroll Calendar for Financial Planning

The payroll calendar is a valuable tool for budgeting and financial planning. It allows you to track your income and expenses, and plan for future financial goals.

One way to use the payroll calendar for budgeting is to calculate your take-home pay. This is the amount of money you will receive after taxes and other deductions have been taken out. To calculate your take-home pay, simply multiply your hourly wage by the number of hours you work each pay period. Then, subtract any taxes or other deductions that will be taken out of your paycheck.

Once you know your take-home pay, you can start to create a budget. A budget is a plan for how you will spend your money each month. When creating a budget, it is important to track your expenses. This will help you see where your money is going, and where you can cut back.

There are many different ways to track your expenses. You can use a spreadsheet, a budgeting app, or simply write down your expenses in a notebook. The important thing is to be consistent and track your expenses regularly.

By using the payroll calendar and tracking your expenses, you can create a budget that will help you reach your financial goals. Here are some tips for maximizing financial stability based on the payroll schedule:

Set financial goals

- Start by setting financial goals. What do you want to achieve with your money? Do you want to save for a down payment on a house? Pay off debt? Retire early?

- Once you know your goals, you can start to create a plan to achieve them. The payroll calendar can help you track your progress and stay on track.

Live within your means

- One of the most important things you can do for your financial stability is to live within your means. This means spending less money than you earn.

- To live within your means, you need to track your expenses and create a budget. Once you know where your money is going, you can start to cut back on unnecessary expenses.

Save money

- Saving money is essential for financial stability. The more money you save, the more you will have to fall back on in case of an emergency.

- There are many different ways to save money. You can start by setting up a savings account and making regular deposits.

Invest your money

- Investing your money is a great way to grow your wealth. However, it is important to remember that investing involves risk.

- Before you invest, you should do your research and understand the risks involved.

Seek professional help

- If you are struggling to manage your finances, don’t be afraid to seek professional help.

- A financial advisor can help you create a budget, develop a savings plan, and make investment decisions.

Changes and Updates to the Payroll Calendar

The payroll calendar is subject to changes and updates due to various reasons, such as adjustments to the school year, holidays, or unforeseen circumstances. It’s crucial to stay informed about these changes to avoid any confusion or inconvenience.

Process for Making Changes or Updates

Changes to the payroll calendar are typically made by the school district’s Human Resources (HR) department. They will communicate these changes through official announcements, emails, or updates on the school district’s website. It’s important to check these sources regularly to ensure you have the most up-to-date information.

Reasons for Changes

Changes to the payroll calendar can occur for several reasons:

– Adjustments to the school year: The start and end dates of the school year may vary from year to year, which can impact the payroll schedule.

– Holidays: The timing of holidays can affect the payroll schedule, as employees may receive additional pay or time off during these periods.

– Unforeseen circumstances: Events such as inclement weather or other emergencies may necessitate changes to the payroll schedule.

Tips for Adjusting to Changes

To adjust to changes in the payroll schedule, consider the following tips:

– Review the updated payroll calendar carefully: Pay attention to the dates of upcoming paydays and any changes to the schedule.

– Adjust your budget accordingly: If your payday is moved forward or back, adjust your budget to ensure you have sufficient funds until the next payday.

– Communicate with your creditors: Inform your creditors about any changes to your payroll schedule to avoid late payment fees or penalties.

Additional Resources and Support

WCPSS provides employees with various resources to assist with payroll-related inquiries.

The online HR portal offers a wealth of information, including access to pay stubs, W-2 forms, and tax documents.

Payroll Department Support

The payroll department is dedicated to supporting employees with any payroll-related questions or concerns.

Employees can contact the payroll department via email, phone, or in person during designated office hours.

Frequently Asked Questions (FAQs)

- When is payday? Payday is typically on the last business day of each month.

- How can I view my pay stub? Pay stubs are available through the online HR portal.

- What deductions are taken from my paycheck? Deductions may include taxes, health insurance premiums, and retirement contributions.

- How do I report a payroll error? Payroll errors should be reported to the payroll department immediately.

FAQ

Where can I access the WCPSS Payroll Calendar online?

You can access the WCPSS Payroll Calendar online through the employee portal.

How do I calculate my paycheck amount using the payroll calendar?

To calculate your paycheck amount, multiply your hourly wage by the number of hours worked during the pay period. Then, subtract any applicable deductions, such as taxes, insurance, or retirement contributions.

What should I do if there is a change to the payroll schedule?

If there is a change to the payroll schedule, you will be notified in advance. Be sure to adjust your financial plans accordingly and contact the payroll department if you have any questions.